How To Buy The Best Burial Insurance In Alabama 2024

You may get all you need here if you’re looking for the greatest funeral insurance in Alabama. Additionally, you will be able to acquire a quick Alabama price for final expense insurance.

Alabama burial insurance is a type of insurance that provides a death benefit to your beneficiaries upon your passing.

The benefit can be used to pay for funeral expenses, unpaid debts, or any other expenses your loved ones may have following your passing.

Whole-life insurance, such as burial insurance, accrues cash value over time. It is possible to borrow money against the insurance’s cash value, pay premiums, or completely cash out the policy using this value.

If you live in Alabama, you might be unsure if burial insurance is appropriate for you. Read on to find out more about the advantages of burial insurance and how to choose the right plan for your requirements.

What Is Burial Insurance in Alabama

In Alabama, burial insurance is a sort of life insurance plan made to assist shield you and your family from the price of a funeral.

Your beneficiaries will receive a lump sum payout in the event of your passing, which they can use to cover your funeral and burial expenses.

In Alabama, a burial funeral service typically costs $7,271. However, cremation costs on average $6,314.

If you have the resources to pay for these expenses, you might not need this insurance.

To pay for the services, many people must borrow against their assets or use credit cards because they don’t have enough money in their savings accounts.

Alabama’s Diabetic Insurance Solutions will assist if you’re seeking for inexpensive burial insurance that won’t break the bank but still provides piece of mind.

Who Needs Burial Insurance in Alabama

Anyone who wants their family members’ final costs to be covered might benefit from burial insurance and/or final expense insurance Alabama if they have dependents on them for financial support.

It’s a good idea to think about acquiring coverage even if you don’t now have dependents but may in the future (for example, if you have children). This is especially true if you’re older than 60 and have health issues.

Instantly compare prices from the top 18 A/A+ rated carriers, or call Hassan (855) 468-8900. FINAL EXPENSE INSURANCE DONE DIFFERENTLY IN THIS AREA

What Type Of Burial Insurance Is Available In Alabama

Alabama provides a variety of burial insurance options, including:

Term Life Insurance –Life insurance that is only effective for a set period of time, such as one year or five years, is known as term life insurance. Let’s say something occurs within this time, and the insured person passes away.

In that situation, the insurance provider makes a lump sum payment to the beneficiary based on the decedent’s age at death and the level of coverage they chose when buying their policy.

Ask Lisa and Danny if you want Alabama Term life insurance rates.

Whole Life Insurance –Lifelong coverage is provided through whole life insurance, which is more expensive than term life insurance. As long as the payments are paid, the policy is in force.

Additionally, this kind of coverage has a cash value element that increases over time and can be utilised to assist in covering the policyholder’s final costs.

We offer both regular whole life and whole life with a simplified issue, such Alabama burial insurance.

Universal Life Insurance –Universal life insurance is a type of permanent life insurance that provides customizable premium and coverage options.

Both the amount of coverage needed and the frequency of premium payments are up to the policyholder.

A universal life policy also has a cash value that increases over time and can be used as collateral for loans if necessary.

How Does Burial Insurance In Alabama Work

In Alabama, burial insurance functions differently from most life insurance plans because it only pays for your funeral expenses and does not provide payouts in the event of an untimely or early death.

The main benefit of this kind of policy is that it makes sure there are no unforeseen costs associated with your funeral arrangements after your passing.

Depending on the kind of coverage chosen, the finest burial insurance in Alabama operates in a specific way.

Depending on the insured party’s age and health at the time they apply for coverage, some plans offer set amounts, while others offer variable amounts.

What Are The Benefits Of Burial Insurance In Alabama

If you live in Alabama, burial insurance Alabama has numerous advantages.

Protect Your Family:

In Alabama, burial insurance helps shield your family from the cost of paying for your funeral. The last thing your family and friends need to worry about during this trying time is the cost of the funeral.

Accidental Death Coverage:

This insurance will provide benefits if you pass away as a result of an accident, such as one involving a car or one at work. This coverage will also pay out if an injury suffered at work causes you to miss time from work.

No Medical Exam:

In Alabama, purchasing burial insurance does not require undergoing a medical examination. Burial insurance is not based on your health or way of life, unlike life insurance policies. It implies that even if you have an illness or previous health concerns, you can still obtain burial insurance coverage without undergoing a medical examination.

Guaranteed Benefits:

The best way to protect against funeral expenses is with burial insurance. With guaranteed benefits, you won’t have to worry about covering your funeral costs out of pocket.

How Much Does Burial Insurance Cost in Alabama

A number of variables, including age, health, and coverage, will affect how much burial insurance in Alabama costs. But insurance plans normally begin at roughly $30 a month.

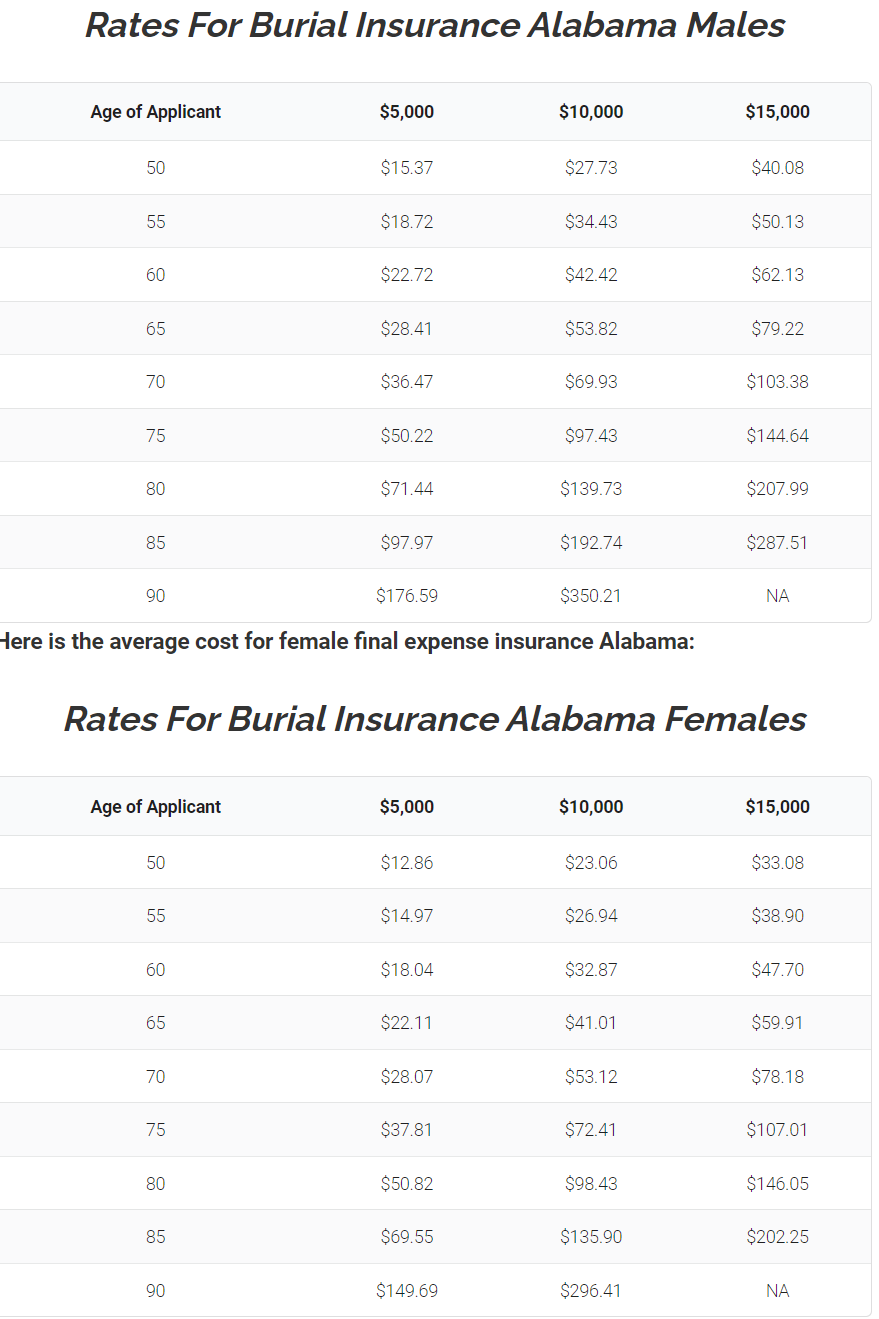

The typical price for male final expense insurance in Alabama is as follows:

The Alabama Free Look Period

The state offers a ten-day free look period. If you purchase the insurance and later decide it’s not for you, you have a set amount of time to cancel it and receive a full refund.

There is no requirement to give a justification or explanation. If you want to receive a refund for the initial premium, you can discard your policy.

If you decide to keep the policy after this time has passed, you cannot receive a refund of your insurance premiums.

This clause offers protection to consumers. If you purchase a policy that is more comprehensive than you anticipated, you shouldn’t be concerned.

If you decide against it after the “free look” period, you can get your money back. In that case, the only thing you would lose is some time.

Alabama’s Life Expectancy

The average lifespan of people living in Alabama is 75.40 years. This rate is without a doubt one of the lowest in the nation.

When you become aware that you are currently unprotected, it would be beneficial to act right away.

Are burial insurance policies available to everyone in Alabama

Purchasing a funeral plan does not require a medical evaluation. Seniors who currently have health issues can still obtain guaranteed life insurance.

Instead of inquiring about your health, businesses employ a waiting time as protection for themselves.

If the policyholder person passes away while the waiting period is in effect, you will pay the beneficiaries. If the insured person passes away while the waiting period is in effect, you will receive a refund.

You may be eligible for a lower rate, a larger burial benefit, as well as many other advantages by providing some information about your health.

Alabama’s Leading Causes Of Death

These are the top ten leading causes of death in Alabama:

Accidents

Heart condition

lung condition

Cancer

Stroke\sInfluenza/pneumonia

Alzheimer’s\sDiabetes

Blood toxicity

kidney and nephritis disease

How To Find The Best Burial Insurance Policy

Numerous insurance providers may provide your company one of their many insurance options. Here’s how it works:

Not all burial insurance companies are the same. Some of them only represent one insurance provider. They often only work with a few businesses.

We vary from one other in three key ways. With these three issues, DiabeticInsuranceSolutions .com can be of assistance. Our company’s main objective is to assist clients in finding jobs that match their interests and skill sets.

Our goal is to match every consumer with the insurance provider that best suits their needs. We have no financial or other connection to the insurance company you select.

We can compare insurance policies from several firms as a sole insurance agency without jeopardising your interests.

We excel in last-minute insurance because it is our area of specialisation. Since we specialise in last-minute insurance, we are fully knowledgeable about each coverage.

We effortlessly obtain authorizations due to our experience. To figure out which insurance companies will take you, you must understand how they underwrite.

Applying to a business that won’t hire you is a waste of time and a morale killer.

You require us if you require burial insurance. We are the only company that can provide you with the greatest policy to suit your needs.

In this world, there are two types of people: those who plan and those who don’t. So, don’t be alarmed. Nevertheless, we can help you locate a policy that satisfies your requirements.

Final Thoughts On Burial Insurance In Alabama

In Alabama, burial insurance is a sort of insurance that is absolutely necessary. Burial insurance can assist in covering the higher-than-average funeral costs in this state.

Many various types of burial insurance policies are available, so it is crucial to research alternatives and choose the best coverage for your needs.

Call us for a free quote to get going. Please contact us at (855) 468-8900 if you have any questions.