![The Truth About Life Insurance For Seniors Over 85 [Review]](https://images.leadconnectorhq.com/image/f_webp/q_80/r_1200/u_https://storage.googleapis.com/msgsndr/Ot7Yu4y4ddf8J29mwv9d/media/65d04ab35ef052c7e3379e4b.jpeg)

The Truth About Life Insurance For Seniors Over 85 [Review]

Life insurance can be purchased at any time to safeguard a person’s family. Call us right away to learn more about the best life insurance for seniors over 85 who don’t require a medical exam or waiting period.

I’m Hassan Sanders, a life insurance specialist with over 9000 policies written, and I’ve worked in the investment and insurance sectors since 2008.

When 99.9% of the agents tell you there are no options for seniors above the age of 85, I will explain what those possibilities are.

Do I need life insurance if I’m over 80? Can you get senior life insurance if you are 86 and over

Whole life is the only type of life insurance offered to anyone 85 years of age or older.

Due to your age and current situation, they are few and far between—there are no term policies, universal life insurance, or accidental death coverage insurance for seniors over 85!

A fantastic approach to guard your family from financial loss in the event of your passing is through life insurance.

The full life plan operates as follows:

Maximum coverage cannot be purchased with monthly premiums, and unless you decide otherwise, it will always be in effect!

If all requirements are completed, you may cancel at any time without incurring any fees. There is no cap on the amount or type of payments made tax-free when the beneficiary(ies) need them.

You now know the basics of how these plans operate. Stop worrying about every little detail; we’ve got this. There are no hidden traps, and if something does go wrong, it’s all in one spot for your evaluation.

What is final expense and burial insurance

The terms “final expenditure” and “funeral insurance” both refer to burial insurance. When referring to a certain type of life insurance that has been available for many years, Burials & Funerals Insurance, it’s like saying “dozen” or “twelve”!

In actuality, the meaning of each of the three names used to describe these categories is rather clear.

Final expense insurance is exactly what it sounds like—a cheap method (literally) to cover your funeral expenses in the event that you pass away suddenly and there are no survivors.

However, if someone passes away unexpectedly, burial insurance also pays for their funeral.

Finally, the terms “funeral, final expenditure, and burial insurance” can cause some confusion.

Some people today are looking for permanent life insurance that has very lax underwriting requirements so they can still be approved.

Simply put, “whole-life” refers to an insurance that covers your entire lifetime.

Best life Insurance Companies For Seniors Over 85

Above all, 85 years of age and older represents a very small fraction of persons who are eligible for life insurance.

There are only a few options on the market for coverage, and they only go up to $25K!

For our senior clients, we offer 3 packages, one of which starts providing coverage at age 90.

That’s correct! Age 90!

The top 3 products, offered by two carriers, that will cover a variety of health impairments are listed below.

AETNA (ACI)

This is the one for you if you are in good health and need life insurance above the age of 85.

They provide three different benefit plans: Level, Graded, and Modified. For those above 85, there is only the level plan.

Level

Ages: 45 to 89, level issues

Minimum compensation: $2,000

Over 85, the maximum benefit is $25,000

available in all states excluding New York and Massachusetts

Instantaneous coverage, no waiting period

While on the phone, immediate approval

AETNA/CVS Health (ACC)

Level (Preferred/Standard)

Ages of issues: 40-89

Minimum compensation: $2,000

Over the age of 85, the maximum benefit is $25,000

possesses a preferred and standard rate Class

available in all states excluding New York and Massachusetts

Instantaneous coverage, no waiting period

Instant approval while on the phone, signature for the security question

It provides instant covering for COPD without oxygen. Additionally, minor health concerns. only scans the prior 1-2 years for significant health conditions.

Guarantee Trust Life (GTL)

Graded Benefit

Issues range in age from 40 to 90.

$2,500 as the minimum death benefit

Over 85, the maximum death benefit is $10,000.

Gradually increasing death benefits: in the first year, the death benefit equals the premiums paid plus 5%; in the second year, it equals 50% of the face value; and in the third year, it equals 100% of the face value.

FULL death benefit is paid from the first day of an accident

6 simple questions, easy application, immediate approval

Given that no other option would pay 50% of the death benefit in year two, this is a fantastic choice for persons who have recently experienced health concerns.

Few providers will provide coverage for those over 85. State Farm is only useful for vehicle and home insurance, and carriers like Foresters only sell plans up to the age of 80.

How much will it cost if I am over age 85

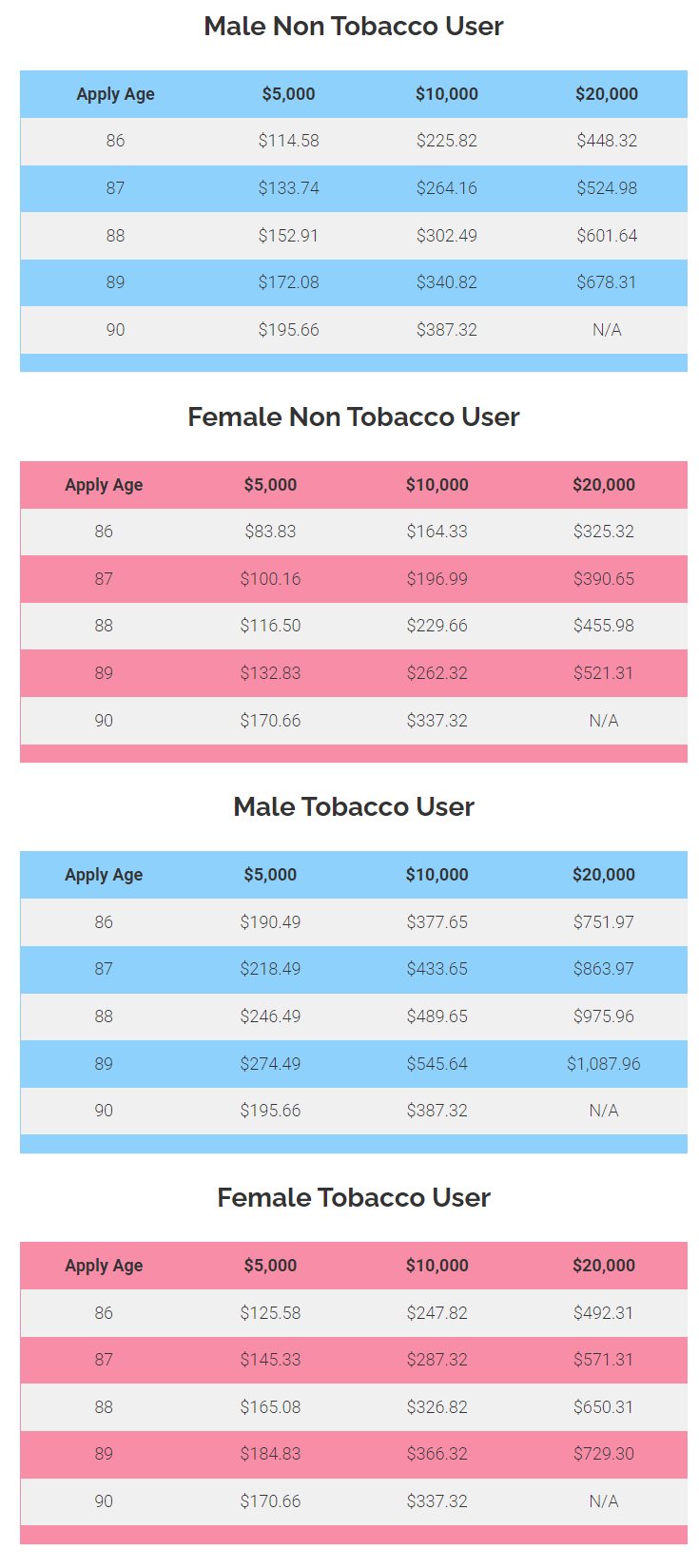

The quotes for final expense life insurance for seniors over 85 are listed below.

Keep in mind that you can purchase life insurance coverage in any quantity, but the greater the level ($2,000–$10,000) you select, the higher the monthly cost will be (high prices).

The rates below compare smoking vs not smoking for each gender.

How long is the waiting period

The bottom result is that seniors over 85 who purchase life insurance have a two-year waiting period or immediate coverage. Depending on one’s health.

Click here to find out whether you’re eligible and to request an email with a pre-approval.

The insured’s premiums will be repaid to them with interest at 5% in year one and 50% of the death benefit in year two if they are rated and die within this period for reasons other than accidents.

Life insurance is a requirement for everyone over the age of 85. You will either have coverage starting on the first of the month or none at all if they reject you outright on the moment without even looking at this option!

What is the contestability clause in life insurance

No of the kind or issuer, all whole, universal, and term life insurance contracts contain an incontestability clause.

This clause gives insurers the right to look into any death that occurs within the first two years (in some states, it’s only one), especially if there are any suspicious circumstances surrounding the passing of your loved one, like possible foul play, or in situations where they weren’t even covered by the aforementioned company at all!

If this clause is present, you cannot get US-based coverage from ANY carrier unless you expressly request it when you order your product.

The insured’s medical records will be requested and examined by an outside physician if they pass away during the first two years of their term life insurance policy. The death benefit will be paid if there are no indications that they misrepresented themselves in any way.

Being cautious is crucial because this process is complicated. However, their policy will not be paid with no death benefit given out or even returned by the firm if they do discover proof of misrepresentation.

There is no need to fear if you are sincere in your application. Even if your life insurance policy were only in effect for two hours, it would still pay you in full.

Let them conduct their research! The basic line is to always be honest!

Eligibility requirements for seniors over 85

Don’t be concerned about the medical examination if you’re looking for your parents’ life insurance coverage. In fact, if you’re over 85, you shouldn’t require a thorough physical—just provide some answers to some questions about your health!

The good news is that it’s time to provide some basic health information if you reside in one of the states where coverage is actually offered.

We may have to go through grading if any of your responses are negative and there is a deterioration at this age.

Here are a few illustrations of health-related questions:

1) Have you been ordered to enter or are you now confined in a hospital, nursing home, skilled nursing facility, psychiatric facility, or prison facility?

2) Have you received or been counselled to receive hospice or home health care?

3) Do you require assistance from anyone for any of the following activities of daily living: taking medication, bathing, clothing, eating, using the restroom, getting in and out of bed or a chair, or moving around? Do you use a wheelchair or mobility scooter?

Within the past year have you:

1) Within the last 12 months, have you undergone renal dialysis or used oxygen equipment to help with breathing (apart from CPAP for sleep apnea) or been advised to do so?

2) Aside from tests for the Human Immunodeficiency Virus (HIV), have you been advised to undergo any medical operation, surgery, or diagnostic test that has not yet begun, been finished, or the results of which are unknown?

3) As a result of a diabetes-related condition or complication, did you undergo an organ or bone marrow transplant, or were you given the go-ahead to do so?

4) Have you ever had an AIDS diagnosis or been tested for the AIDS Related Complex (ARC), the Human Immunodeficiency Virus (HIV), or Acquired Immune Deficiency Syndrome (AIDS)?

Have any of the following conditions ever been identified in you?

1) Amyotrophic lateral sclerosis (also known as Lou Gehrig’s disease), Huntington’s disease, or sickle cell anaemia.

2) Dementia, Alzheimer’s disease, or mental impairment?

3) End-stage disease, pulmonary fibrosis, any terminal condition, or congestive heart failure?

4) Muscular dystrophy, cystic fibrosis, cerebral palsy, or untreated heart defects?

5) With the exception of basal or squamous cell skin cancer, have you gotten a cancer diagnosis within the last two years, had chemotherapy, or been advised to do so?

6) Have you ever had more than one instance of the same or a different type of cancer diagnosed?

Have you gotten a diagnosis, treatment, or prescription recommendation? Have you used illegal substances, abused alcohol, or used prescription or illicit drugs during the last two years? Have you also been found guilty of or entered a plea of guilty to driving while intoxicated?

retinopathy (an eye condition), nephropathy (a kidney disorder), or neuropathy (a nerve, circulatory disorder) are examples of complications of diabetes.

liver or kidney disease

Have you had a heart attack, angina (chest pain), cardiomyopathy, or any other heart- or circulatory-related diagnosis, treatment, or recommendation in the last year?

Aneurysm, brain tumour, transient ischemic attack (TIA), or stroke?

Have you had a heart attack, angina (chest discomfort), cardiomyopathy, a procedure or surgery involving the heart or circulatory system, or been prescribed medication within the last two years?

Aneurysm, brain tumour, transient ischemic attack (TIA), or stroke?

Have Parkinson’s disease, Multiple Sclerosis, or Systemic Lupus Erythematosus (SLE) ever been diagnosed, treated, or prescribed to you?

emphysema, chronic bronchitis, chronic obstructive pulmonary disease (COPD), or any other persistent respiratory ailment?

Will they check my medications

The purpose of the life insurance company’s computerised analysis of your medication history is to confirm any potential health issues you may have.

For instance, they won’t accept me if I refuse the inquiry concerning dementia but fill a previous prescription for medication that is somehow associated with dementia (or even merely classified under “Dementia”).

The depth of the company’s knowledge and comprehension of the purposes of drugs will be taken into consideration during the qualifying procedure.

Carrier application process for life insurance over 85

If you’re curious about how to apply for the elderly over 85, we offer the best procedure!

Applications from AETNA (ACC), AETNA (ACI), and Guarantee Trust Life are the fastest and most effective in the market.

It’s so easy, in fact, that you might pinch yourself when it’s over to be sure you weren’t dreaming.

AETNA Application Process

For AETNA CVS/Health and AETNA (ACI), 99% of the work can be completed by email, but I must first meet with you in order to submit your application for approval.

Check your details, such as beneficiary and payment date, etc.

A “Security Question,” such as “What street did you grow up on,” is used to sign documents.

Then When automated underwriting takes over, you quickly receive your insurance number and are accepted!

GTL Application Process

When we call 855-468-8900 to verify with GTL, an automated service will ask us the following questions:

Entire name

Date of birth and the last four digits of a social security number

Name of the second applicant (if applicable)

Application for the product from GTL and any other items, if any

insurance company Record’s title

Verbal acknowledgement that they understand the application’s questions and provided accurate answers.

Verbal acknowledgement that they are aware that regular premium payments are necessary to keep coverage if their insurance application is approved.

Then we are off the phone, then we fill out the application that has these qualifying questions:

Do you currently get renal dialysis, need daily oxygen (other than CPAP), have an implanted defibrillator, or have you recently gotten or received advice from a qualified medical professional about getting an organ transplant?

Are you now receiving treatment for memory loss or have you ever received a diagnosis of Alzheimer’s disease or dementia from a licenced medical professional?

Do you now have cancer? (Excluding Stage A Prostate Cancer, Carcinoma in Situ, Squamous Cell or Basal Cell Carcinoma) Have you received a cancer diagnosis during the last twenty-four months? Have you been prescribed any medications?

Have you ever undergone or had a qualified medical professional advise you to have an amputation because of diabetic complications? Yes No

Are you now bedridden, confined to a hospital, nursing home, mental health facility, long-term care facility, hospice, or have you received a diagnosis of an end-stage or terminal illness, or have you received a prognosis of fewer than 12 months from a certified medical professional?

Have you had an HIV test that came back positive within the last ten years? Have you had a doctor diagnose you with ARC, AIDS, or another illness or condition resulting from an HIV infection?

Conclusion

Life insurance can be purchased at any time to safeguard a person’s family. We identified the best carrier for seniors over 85 who don’t need a medical exam or waiting period, whether you are seeking for a policy that won’t require a medical exam or waiting period.

Simply give us a call right away, and we’ll assist you acquire the protection your family needs. Fill out the form on the right to request a quote!