How To Buy Burial Insurance For Seniors Aged 81

You’ve come to the right place if you’re looking for 81+ burial insurance.

We’ll examine the criteria you should use in your search, the rates that are available, the carriers that are ideal for people 81 and older, and the procedure for settling your family’s death claim.

Above all, we’ll make this clear-cut and uncomplicated.

Please feel free to select “Compare Quotes” whenever you are ready to view rates.

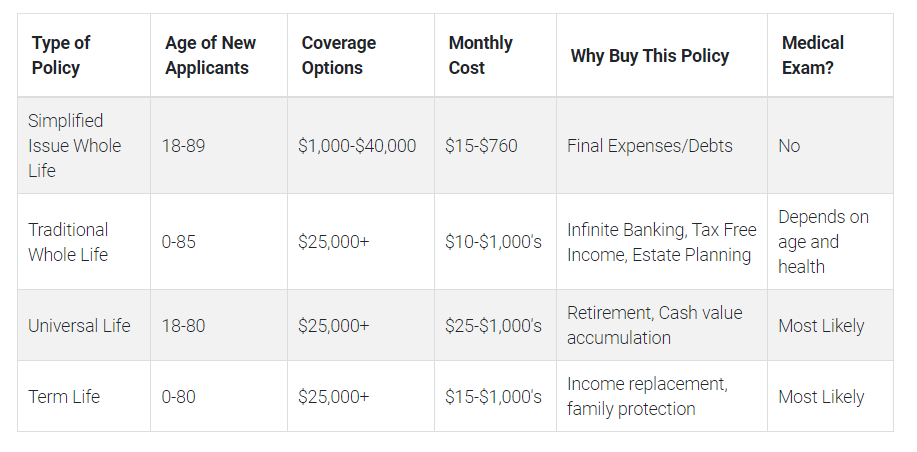

What Type of Life Insurance is Best For Seniors Aged 81

Above all, when looking for burial insurance for seniors at age 81 you are pretty limited. In fact, term life, universal life, and most traditional whole-life policies most likely aren’t available over age 80.

The simplified issue whole life, however, is intended for people beyond the age of 80.

These are laws that you may be familiar with. They go by a variety of labels to convey their precise nature, which is a simplified problem throughout existence.

Several names are:

Burial Insurance

Final Expense Insurance

Cremation Insurance

Funeral Insurance

End of Life Insurance

Make no mistake, these are ALL the same!

What is Simplified Issue Whole Life Insurance

Simplified issue whole life insurance does not call for a paramedical exam, in contrast to standard whole life or term life insurance. This is excellent for seniors over 81 who are searching for burial insurance.

In fact, a few simple health-related questions and information about the prescriptions you are taking ought to be enough to quickly approve you.

You will either need a waiting period or not based on one of four rating classes. The rates you pay will also depend on these rate classifications.

These are the rate classes:

Level Premium (Immediate Coverage/Best Rate)

Level Standard (Immediate Coverage)

Graded/Modified (Usually a one-year waiting period, then a fractional payout the second year, or, a fractional payout for year 1 (30%), year 2 (70%), then full payout on year 3.

Guaranteed Acceptance Policy (Two-year waiting period/ROP)

The questions posed will determine these rating categories. Later on in this post, we will go through these in further detail. Additionally, we offer burial insurance for people over 85 and up to 90.

Let’s first examine certain sample rates, though.

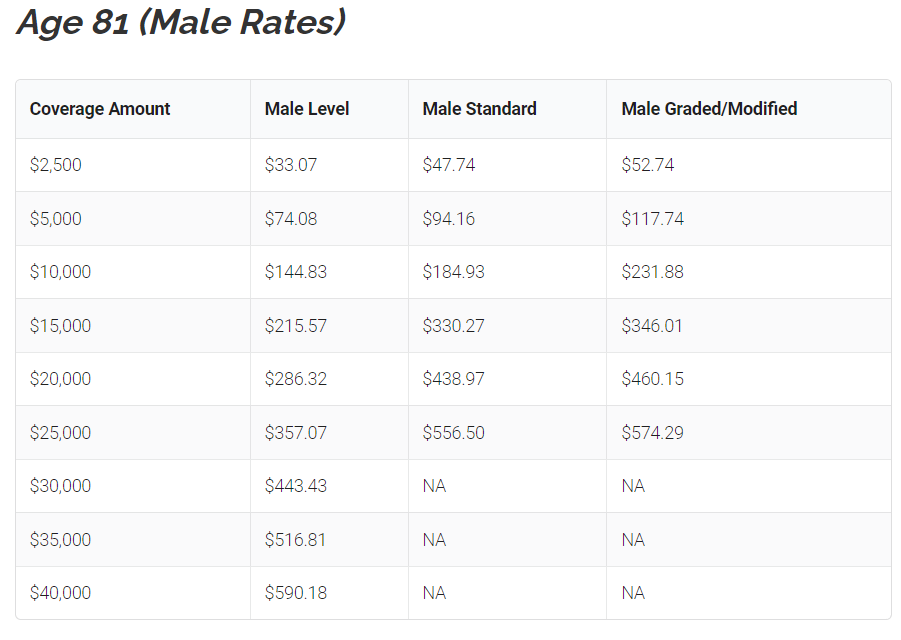

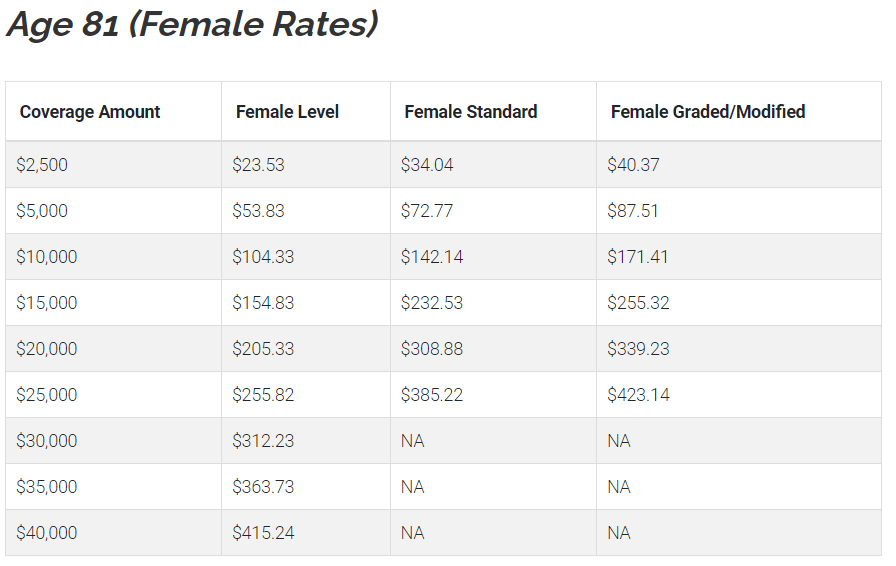

Burial Insurance Rates for Seniors Age 81

Let’s look at some actual rates with major carriers for age 81 now that we are aware of the types of insurance you can get and the rate classes that will affect the cost.

Best Companies For Seniors Over 81 To Get Burial Insurance

Okay, now that you are familiar with rates, the appropriate product, and the meaning of the rating class, let’s look at the business that will be writing a check to your loved ones when the time comes.

Priority one should be given to selecting the best carrier for check-cutting. That will actually depend on the following:

Monetary stability (A.M.Best Rating)

Index of customer complaints

Consumer Assistance

We put a lot of effort into the carriers we recommend to our clients. Every three months, we check on our carriers to make sure everything is good.

Based on a combination of financial soundness, customer service, customer complaints, and what the lowest rate might be, we have assembled the top carriers for people over 81.

Underwriting Process When Buying Burial Insurance For Age 81

Seniors are most frequently subjected to Jonathan Lawson’s TV advertisements, who serves as Colonial Penn’s paid spokesperson. Additionally, solicitations from AARP and Globe are fluttering through your mailbox.

Dare I say it, ALL of these policies have a two-year waiting period? Furthermore, the majority are not actual lifetime policies. Stop falling for the convenience trap since doing so will only harm your family.

These carriers will advertise “Instant Approval” or “No questions asked,” which are hybrid gimmicks. They also cost 30 to 50 percent more.

For instance, waiting time rules are provided by both Open Care and Physicians Mutual.

You must provide your health information if you want the best policy available. In fact, if you’ve had applications rejected in the past, don’t give up.

More than half of our clients who have been rejected come to us, and we locate them no-waiting-period coverage right away.

Health Questions That Need To Be Answered

In order to match our clients with the most suitable carrier, we ask them the following qualifying questions:

1. Has the proposed insured been advised to receive treatment in a nursing home, hospice, or home health care?

(a) bedridden or confined to any hospital, nursing home, long-term care facility, or skilled nursing facility?

(b) in need of assistance with activities of daily living such managing bowel or bladder issues, taking medications, bathing, dressing, eating, going to the bathroom, or getting in and out of a chair or bed?

(c) in need of a wheelchair, an electric scooter, or oxygen equipment to help breathing (other than use for sleep apnea)? (Except for fractures, bone or joint surgery, including replacement)?

2. Has the proposed insured ever:

(a) received a diagnosis of acquired immune deficiency syndrome (AIDS), AIDS related complex (ARC), or human immunodeficiency virus (HIV) infection from a doctor or healthcare professional; or received treatment for AIDS, ARC, or HIV?

(b) been given a diagnosis of, received treatment for, or received advice from a doctor or healthcare provider to seek treatment for any of the following conditions: Alzheimer’s disease, dementia, Huntington’s disease, sickle cell anemia, myelodysplastic syndrome (MDS), Lou Gehrig’s disease (ALS), quadriplegia, paraplegia, Down syndrome, mental incapacity, congestive heart failure, cirrhosis, metastatic cancer, or recurrent cancer

(c) been given an insulin shock diagnosis, been placed in a diabetic coma, undergone an amputation because of a diabetic complication, been given an end-stage renal disease diagnosis, or needed dialysis?

(d) been advised to have an organ or bone marrow transplant or already have?

(e) has been identified by a doctor or other healthcare professional as having a terminal medical condition that would likely cause death during the upcoming 12 months.

3. Has the proposed insured received any of the following in the last 12 months:

(a) medical advice to undergo surgery, diagnostic testing other than for routine screening or for HIV/AIDS-related issues, treatment, hospitalization, or another procedure for which the findings are unknown?

(b) been identified as having heart disease or undergone any type of cardiac surgery by a doctor or other healthcare professional?

4. In the past 2 years,

(a) has the Proposed Insured been diagnosed with, treated for, or advised by a physician or health care provider to receive treatment for any form of cancer (except basal or squamous cell skin cancer)?

5. Has the proposed insured ever:

(a) received care or treatment for, or been counselled by a doctor or healthcare professional to seek treatment for: diabetes before age 50 or diabetes at any age with complications of retinal degeneration (eye), kidney nephropathy, peripheral vascular disease (PVD or PAD), or neuropathy (nerve)?

(b)Hepatitis C,

(c) Chronic Lung Disease, such as Sarcoidosis, Chronic Bronchitis, Emphysema, or Chronic Obstructive Pulmonary Disease (COPD)?

6. Has the proposed insured person sought treatment for any of the following conditions in the last four years:

(a) cancer, leukemia, melanoma, or any other internal malignancy (apart from basal or squamous cell skin cancer)? been instructed by a doctor or other healthcare professional to do so?

(b) Scleroderma, systemic lupus, or chronic kidney disease?

(c) Multiple Sclerosis, Schizophrenia, Parkinson’s Disease, or Bipolar Depression?

7. Has the proposed insured in the last two years:

(a) undergone care or treatment for; or been advised by a doctor or healthcare professional to seek treatment for:

(b) Coronary Artery Disease, Heart Attack, Coronary Artery Bypass Surgery, Angioplasty, Cardiomyopathy, irregular heart rhythm, or Valvular Heart Disease with surgical repair or replacement?

(c) Have you ever experienced a transient ischemic attack (TIA), a stroke, or both? If so, when?

8. Has the proposed insured:

(a) been convicted of, or is presently undergoing trial for, a felony in the previous two years?

(b) Have you ever been found guilty of reckless driving or operating a vehicle while intoxicated or impaired by drugs or alcohol more than once?

(c) misused or abused prescription medicines, or utilized illicit drugs of any kind?

9. In the past 2 years,

(a) Has the proposed insured person ever been admitted to the hospital by a doctor or other healthcare professional for a mental or nerve problem in the previous two years?

10. Has the proposed insured visited a doctor in the last 12 months

(a) for a persistent cough, an unexplained weight loss of more than 10 pounds, exhaustion, or unexplained gastrointestinal bleeding?

To choose the most affordable life insurance with an A+-rated provider, the following questions must be addressed.

Even if you gave a “No” response to one of these questions, you are not automatically rejected. Every carrier has a market for people with health impairments, and this helps us decide where to bring you.

Process of Placing a Death Claim For Age 81

You need to be aware of a few things if a loved one has a funeral insurance coverage at age 81.

If you are the beneficiary, there are typically two things you should be aware of before submitting a death claim.

The first thing to determine is whether the waiting time for your loved ones’ coverage has passed.

Second, are they no longer contestable after two years? This indicates that the insurance company may contest the policy if your loved one passes away within the first two years of the policy’s activation.

Let me clarify. It will pay out whether death results from accidents or natural causes. If a sickness was the reason, it should have been disclosed on the application when it was submitted.

The insurance company must be informed that the application was truthful and contained no false information. If there aren’t any, the insurance pays out without any issues.

This is why it’s crucial to provide complete, accurate, and honest answers to all of the application’s questions. Trust me, the insurance provider will learn the truth.

Death Claim and Death Certificate

When a loved one dies, two things are required.

A copy of the death certificate

Completely filled out death claim form

These are crucial for obtaining the death benefit quickly and effectively when your loved one, who is 81 years old, has a burial insurance policy. It would be wise to address this with your loved one’s doctor if they are suffering from an illness and have been holding off for several weeks. You can quickly obtain the death certificates in this manner.

I received the death certificate five hours after my mother died in 2016, when she passed away. You will if you are ready for it.

Additionally, the beneficiaries must complete the death claim form. The carrier claim department will then need to receive these documents by mail in order to handle them.

After being processed, the death benefit will be mailed to the recipient; however, if requested, they may also wire the money.

Final Thoughts

In addition to the greatest product for you at age 81, I hope this article helped you understand the most crucial step in the procedure: what you should avoid.

Call us at (855) 468-8900 if you have any questions, or just fill out the form to compare costs.