![Can An 89 Year Old Get Life Insurance? [No Exam Needed]](https://images.leadconnectorhq.com/image/f_webp/q_80/r_1200/u_https://storage.googleapis.com/msgsndr/Ot7Yu4y4ddf8J29mwv9d/media/65d076ba5ef052369937eb7d.jpeg)

Can An 89 Year Old Get Life Insurance? [No Exam Needed]

Can seniors who are 86 years old buy life insurance?

It’s never too late to start making plans for the future, and getting whole life insurance is a smart move in this direction. Even though you might believe it would be challenging to purchase life insurance at 86 years old, many businesses will work with customers of any age.

Identifying the amount of life insurance or end-of-life expenditure coverage you require is the first step. Next, compare quotes from several firms to find the one that best meets your needs.

After you’ve paid for the policy, you’ll want to double-check that everything is set up properly so that, in the event of an emergency, all of your affairs will be handled as efficiently as possible.

In this essay, we shall explain this.

Can you get life insurance at age 86

Are you aware that people as old as 86 can purchase full life insurance?

Even if some websites claim otherwise, they are either false or misinformed. Over the age of 80, term life insurance is no longer available. But up until the age of 90, we have final expense insurance.

Nothing more than marketing jargon, last expense coverage is essentially tiny insurance with lax underwriting and few benefit alternatives.

Make sure to research whole-life policies if you’re looking for simplified issue whole-life insurance. These policies provide a tone of benefits and are guaranteed to never expire due to the fact that your senior doesn’t age normally.

As long as the insured individual has consistently paid his or her payments during their lifetime, the life insurance coverage will remain in effect regardless of what occurs in the future in terms of accidents, premiums, or both (unless otherwise required by law).

Therefore, you must contact us if you need burial insurance for an 86-year-old parent.

Best Life insurance for seniors Over 80

Seniors over 80 can still purchase most types of life insurance, including universal, burial, and whole life insurance policies.

For seniors over 80, a permanent life insurance coverage is substantially more cost-effective than term life insurance. Aside from that, some policies exempt seniors over 80 from having to undergo a medical examination.

In contrast, you’ll have more possibilities for coverage if you’re in good health and ready to undergo a test.

The cost and type of exam you must take will depend on the life insurance company where you apply, your age, and your health.

Whole Life Insurance

A whole life insurance policy is immediately effective, does not have an expiration date, and does not call for a medical exam. It takes the premium money you give it and turns it into cash.

You never have to guess or worry how your money will increase each year by investing in mutual funds, money market accounts, and equities because none of these are guaranteed.

You won’t need to hazard a guess or wonder because interest rates will increase your money.

This type of life insurance is ideal for persons 85 years of age and older because it is based on compound growth. However, because senior investors’ money has to increase annually, these investments are too hazardous for them.

Once you meet the age criteria for the policy, you will be certain of approval for permanent life insurance coverage, which is restricted to amounts of $25,000 or less and does not require a medical examination.

Burial, Funeral, Final Expense Insurance

The terms “burial insurance policy” and “funeral insurance policy” are interchangeable. A burial insurance policy is designed to pay for funeral expenses after a person’s passing.

With a few particular restrictions, these are effectively entire life insurance products. Because they only cover final expenses totaling $9,600 or more, insurers refer to them as final expense insurance. In actuality, none of these plans demand a waiting period or medical examination. No last expense insurance policy exists that offers coverage similar to a standard policy.

Universal Life Insurance

Guaranteed universal life insurance, which is more expensive than whole life insurance, is a third choice for seniors. However, one deciding element is that it can help seniors save more money.

In contrast to other plans with variable interest rates, a universal life insurance policy has a minimum interest rate. Along with flexibility, it also offers convenience.

Another benefit of universal insurance for the elderly is that if you’re over 85, you can acquire a loan for insurance. To accommodate any changes in your insurance requirements, you can modify your policy.

No matter your age or health history, you are eligible to purchase a guaranteed issue life insurance policy at any point in your life. It is a pure policy of acceptance assurance. They are costly, yet the life insurance sector utilizes them to lose clients.

If you’re concerned about your health or age, you can buy guaranteed acceptance life insurance right away.

Do I need to wait 2 years For Policy To Pay

What a Wonderful Question!

No, if you are healthy and have only minor health difficulties you do not have to wait two years for the policy to pay off. We can obtain you coverage even if your heart attack occurred more than two years ago.

The entire purpose of whole life insurance is that it pays out in the event of your passing.

If you purchase life insurance while you’re still alive, the premiums go towards maintaining the policy in effect so that your loved ones will be financially taken care of when you do pass away.

By doing this, you may make sure that in the event of your insured’s passing, your family won’t be burdened with unpaid utility, tax, and medical costs.

People who meet the requirements can purchase life insurance plans without a waiting period. However, if you meet the requirements, you could still be eligible for this form of life insurance policy even if you have diabetes, high blood pressure, or a history of heart attacks or strokes.

Call us at 1-855-468-8900 (toll-free) day or night, seven days a week, for an agent who will assess if they believe your application qualifies for immediate no-wait protection in less than 60 seconds.

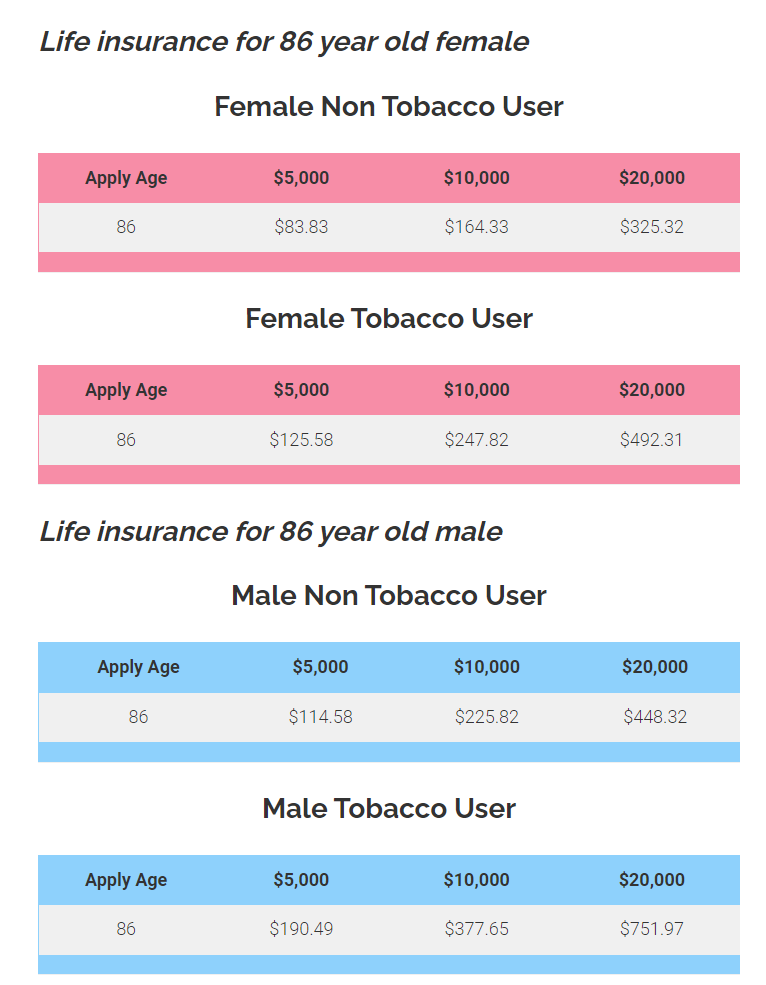

Average Cost For Life Insurance At Age 86

The typical price of life insurance Final expense life insurance for 86-year-olds might cost as little as $2,000 or as much as $25,000.

Your life expectancy is entirely based on your gender and how healthy you are in contrast to persons your age, which also affects their life expectancies.

Click here, complete the prequalification health questionnaire, and we’ll email you a preapproval offer for the best option if you meet the requirements for the rates below.

Our Best Life Insurance Companies For Age 86

Although there are only a few businesses in the USA that will do this, I frequently receive inquiries from customers inquiring whether they can purchase life insurance for their grandparents.

Continue reading if you want to learn more about your alternatives from us at DiabeticInsuranceSolutions.com!

As stated below, it is not possible to purchase a new policy above the age of 85 through an agent directly with any carrier; instead, one must go through an independent insurance firm, like ourselves, who represents these carriers (855-468-8900 x 4).

We can provide life insurance coverage up to age 90, and because we accept same-day application submissions without requesting more evidence, our rates start out lower than those of most providers.

Here are our top 86-year-old carriers:

AETNA (ACI) (ACI)

This is the one for you if you are healthy and searching for life insurance at the age of 86.

They provide three different benefit plans: Level, Graded, and Modified. For 86 years old, there is only the level plan.

Ages: 45 to 89, level issues

Minimum compensation: $2,000

Over 85, the maximum benefit is $25,000

available in all states excluding New York and Massachusetts

Instantaneous coverage, no waiting period

While on the phone, immediate approval

ACC Level (Preferred/Standard) AETNA/CVS

Ages of issues: 40-89

Minimum compensation: $2,000

Over the age of 85, the maximum benefit is $25,000

possesses a preferred and standard rate Class

available in all states excluding Chicago IL

Instantaneous coverage, no waiting period

Instant approval while on the phone, signature for the security question

It provides instant covering for COPD without oxygen. Additionally, minor health concerns. only scans the prior 1-2 years for significant health conditions.

Gradated Benefits of Guarantee Trust Life (GTL)

Issues range in age from 40 to 90.

$2,500 as the minimum death benefit

Over 85, the maximum death benefit is $10,000.

Gradually increasing death benefits: in the first year, the death benefit equals the premiums paid plus 5%; in the second year, it equals 50% of the face value; and in the third year, it equals 100% of the face value.

FULL death benefit is paid from the first day of an accident

6 simple questions, easy application, immediate approval

Given that no other option would pay 50% of the death benefit in year two, this is a fantastic choice for persons who have recently experienced health concerns. Additionally, the rate of tobacco use, including cigarettes and cigars, will be the same as that of non-smokers.

Do I need a medical test to qualify for Burial insurance for Seniors over 80+?

No. For seniors age 80 and older, eligibility for burial insurance does not require a medical exam.

When requesting funeral insurance, there are simply a few straightforward health-related concerns that must be addressed.

Throughout the application process, you won’t be required to provide any medical records or samples of your blood or urine. Typically, the insurance company will offer you a formal clearance in just a few minutes!

How Can I Apply For Life Insurance At Age 86

Fortunately, DiabeticInsuranceSolutions.com can assist you with all of your insurance requirements.

However, the first thing we want our clients to understand is that they should look for an agency that represents Aetna, CVS Health, or Guarantee Trust Life — not a someone who works there directly!

If this sounds like something where advice would be helpful, call us right away.

applying procedure:

The insured will provide medical information (there is no exam required).

We’ll submit verbal authorization to apply and find out within a few minutes to days whether it has been approved or declined.

We normally ship out real copies of policies right away after underwriting approves them so that your life insurance coverage can start on whatever day you wish payments to start right away. Simply put, that is all there is to this.

Conclusion

Because it is a long-term investment, most people wait until they are in their 50s or 60s to buy life insurance. But occasionally an opportunity knocks on your door, and you have to answer right away.

If you wait too long, you might be surprised by how much your life insurance policy will cost!

There is no need to worry about being denied coverage because of age with life insurance quotes from DiabeticInsuranceSolutions.com because they can supply quotations for everyone who needs them regardless of age.

Don’t wait any longer; request your quote now!