Simple Guide To Burial Insurance for Bipolar Disorder

Do you have bipolar disorder? Do you know a bipolar person? If so, you’ll find something useful in this blog post. Bipolar life insurance

I should start by saying that burial insurance is not the same as conventional or bipolar life insurance when referring to people with bipolar disorder. Depending on where your loved one was living when they passed away, funeral expenses can occasionally go into the tens of thousands of dollars.

This kind of coverage might assist in making sure that these costs remain controllable and within any financial restrictions. Contact us right away to get started if you want to speak with an agent; it doesn’t have to be intimidating!

Final Expense Insurance For Bipolar Disorder

Is bipolar disorder a pre existing condition?

The most difficult pre-existing conditions to understand while looking for the finest final expenditure insurance are bipolar disorder and other pre-existing conditions. You’ll have a lot of inquiries. Is bipolar disorder a condition that already existed? is the main query we deal with on a daily basis.

Overall, we are delighted to inform you that, with a diagnosis of bipolar disorder, obtaining affordable burial or final expense insurance will be simple.

Is bipolar disorder a condition that already existed?

YES! In actuality, we are experts in a specific type of health issue.

Furthermore, receiving a bipolar diagnosis may have some profoundly life-altering effects… In the carrier’s opinion, it qualifies as a pre-existing medical condition.

Can you get life insurance with schizophrenia or bipolar disorder?

Yes, Absolutely! Moreover, read on and you will shortly learn that being manic-depressive will have very little to no effect on the qualities of coverage you will be offered.

Insurance Companies And Bipolar Disorder

Can I purchase burial insurance for my bipolar parents? What a wonderful question! Yes, you can definitely succeed in achieving this aim. In fact, the majority of our clients’ adult children contact us every day to assist their parents in achieving this aim!

In general, insurance firms will gladly provide a bipolar applicant with the lowest prices and rapid insurance coverage. It’s uncommon for insurance companies to carefully consider candidates who have bipolar disorder or any other mental health condition.

Bipolar Disorder Underwriting Process

“The truth about bipolar disorder

life insurance underwriting…

What you need to know Today!”

Overall, depending on the insurance provider, the lowest rates with immediate insurance coverage from day one are referred to as “simple,” “preferred,” or “level.”

In light of this, you must apply for burial or final expense insurance with simplified underwriting in order to be eligible for a simplified insurance plan.

Similar to how they do for other health conditions, insurance companies will evaluate claims based on two factors.

Health questions

Prescription history assessment

Your health and medication history will also be reviewed, including any previous medical illnesses you may have had, their dates of occurrence, treatments received, and duration of duration.

Another crucial aspect is that it’s critical to understand that having bipolar will likely lead to the development of a mental disorder resembling schizophrenia, PTSD, and/or depression and anxiety.

Can You Get Life Insurance If You Have Bipolar Disorder

Underwriting Health Questions

To emphasise, insurance providers do not really keep an eye out for mental health issues related to bipolar disease. Underwriting questions from insurance companies won’t include terms like “mania,” “bipolar,” “manic depression,” etc.

In other words, if an insurance provider does not specifically request a health condition, it indicates that they are not rigorous about it and will have no trouble providing final expense insurance at a reasonable price with quick insurance coverage.

So, if your insurance agent says he might have trouble locating a reputable insurance provider for bipolar disorder, it’s time to look for a new representative.

Similarly, it is unheard of for a final expenses insurance provider to inquire specifically about bipolar disorder. The health inquiries will probably inquire about any further medical conditions you could have.

Underwriting Prescription Assessment

Can someone with a mental disorder purchase life insurance? Insurance companies will typically review your prescription history for a cross-reference to determine whether you have any other underlying health conditions they are uncomfortable with.

Do Antidepressants Affect Life Insurance Premiums

Mood stabilisers, antipsychotics, antidepressants, and anti-anxiety drugs are examples of typical bipolar disorder treatments, and insurance companies will have no problems with these medications at all.

Patients with bipolar disorder frequently take the following drugs:

Aripiprazole (Abilify)

Asenapine (Saphris)

Carbamazepine (Tegretol, Equetro, Others)

Divalproex Sodium (Depakote)

Effexor

Emasam

Lamotrigine (Lamictal)

Lexapro

Lithium (Lithobid)

Lurasidone (Latuda)

Marplan

Nardil

Olanzapine (Zyprexa)

Parnate

Paxil

Prozac

Quetiapine (Seroquel)

Remeron

Risperidone (Risperdal)

Valproic Acid (Depakene)

Wellbutrin

Ziprasidone (Geodon)

ZoloftNow, some insurance companies might query why you were prescribed these prescriptions if you’re taking antipsychotics, antidepressants, or both.Other insurance providers will inquire as follows:Did you had or have any suicidal thoughts or attempts? If so, when?

Have you ever harmed your self or attempted to? If so, when?

“If you are asked these questions, you may have applied to an insurance company that does not favor your health condition.”

Best Life Insurance For Bipolar Disorder

Types Of Bipolar Disorder

According to the Diagnostic and Statistical Manual of Mental Disorders, these are the types of bipolar disorder.

Bipolar 1 Disorder: This involves one or more manic episodes of serious mood swings from mania to depression. This could trigger psychotic episodes that can lead to injuries and hospitalizations.

Bipolar 2 Disorder: This is a milder form of mood swing episodes, where there are at least 1 depressive or hypomania that shifts in between severe depression episodes that lasted for 4 or more days.

Cyclothymic disorder: This is where there are brief episodes of hypomania alternating with brief periods of depression symptoms that is not long-lasting as observed in full hypomanic episodes or episodes of full depression.

“Mixed Features” This is where the occurrence of coinciding symptoms of opposite mood polarities during depressive, manic, or hypomanic episodes. Common symptoms are high energy, racing thoughts, sleeplessness and at the same time despair, irritability, hopelessness and suicidalness.

It doesn’t matter whatever form of bipolar disorder you have, as seen above by our top-rated A+ insurance providers.

For instance, if you don’t have any other major conditions, you will essentially be offered simplified issue life insurance for bipolar or the lowest rates with quick insurance coverage.

Effects Of Hospitalizations In Bipolar Disorder

You must realise that any severe episode of bipolar disorder that necessitates hospitalisation will have little to no impact on the final expenditure insurance offers.

The only insurance provider with an A+ rating will not even consider a bipolar applicant’s hospitalisation.

One reason is that it won’t matter if you were asked if you had ever been hospitalised due to a bipolar disorder episode.

With us, you will only receive offers from reputable insurance providers.

How To Find The Best Burial Or Final Expense Insurance For Clients With Bipolar Disorder.

Aside from serious illnesses, the only issue you may face when applying for a final expense insurance plan if you have bipolar disorder is that you were offered policies that are expensive and have waiting periods. Furthermore, this means you have the wrong insurance agent.

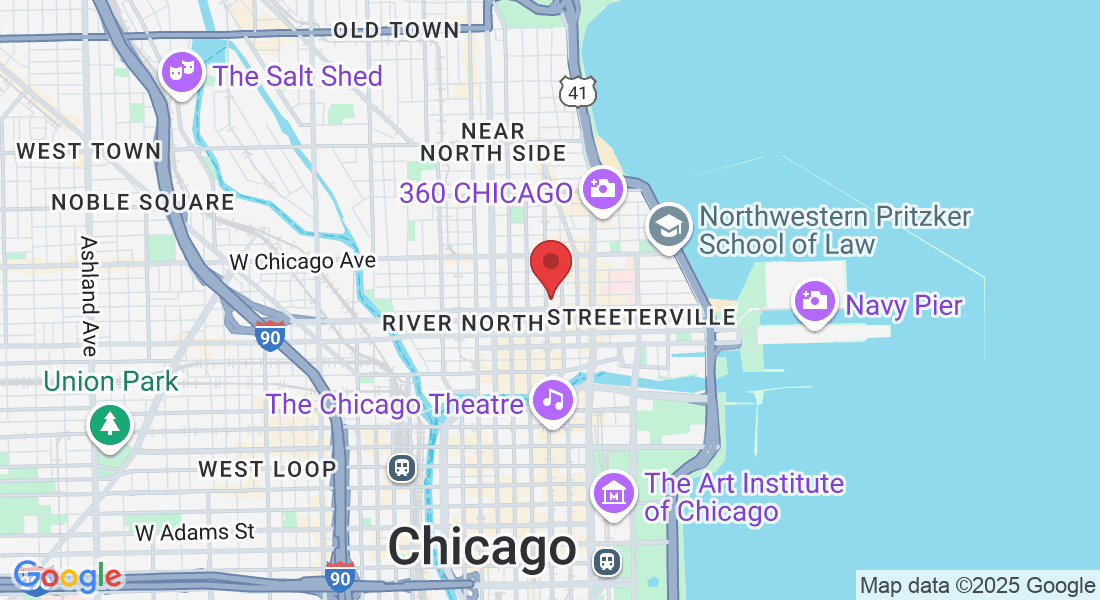

How we here at DiabeticInsuranceSolutions.comcan help you find the best final expense insurance possible for bipolar disorder.

We are formed by a team of highly accomplished final expense insurance specialists that has a passion to find the best possible burial insurance policy for anyone who has Bipolar disorder or other mental illnesses. We have over 26 years of experience helping insurance clients and are licensed in 49 states.

Life Insurance Policies For People With Bipolar

Only top-rated A+ insurance providers who have no issues with bipolar disorder and who have the utmost regard for your health will be contacted by us.

We just need your trust and a few minutes of your time to ask you crucial questions about your health and your present state of any mental diseases.

Contact us right now! We guarantee you a straightforward, stress-free interview process.

For more information on mental illness.

Conclusion

The good news is that it will be simple to obtain low-cost funeral or final expense insurance after being identified as having bipolar disorder. We can help you find the appropriate plan for your needs and are available to answer any concerns you may have about a policy for someone who has been diagnosed with this ailment. Contact us right away so we can determine what’s best for you!