Burial Insurance With Cirrhosis Of The Liver and Liver Disease

Because liver cirrhosis can dramatically shorten life expectancy, it’s crucial for persons who have the condition to get burial insurance.

Unfortunately, a lot of folks wait until it’s too late before realizing they need this coverage. This ignorance frequently results in poor planning, which in turn causes expensive and time-consuming funerals.

Do you have liver cirrhosis and are you having trouble receiving burial insurance? Just give us a quick call, don’t worry. Can you ensure the safety of your loved ones?

Data indicates that Diabetic Insurance Solution provides better prices because they specializes in high-risk life insurance.

We’ll go over how insurance companies evaluate applicants with cirrhosis to assess the amount of risk and what coverage options you have if you have a history of liver cirrhosis and liver illness in this post.

Lastly, ways to locate the ideal financial insurance plan for your requirements.

Burial Insurance with cirrhosis of the liver: Burial Insurance with liver disease

Your burial insurance cannot be terminated because you have liver disease. You have to tell the insurer about it because it’s a fact. Although it is not required, the insurer may decide to raise your premium or revoke your insurance.

You will have to pay higher premiums for your burial insurance if you have liver cirrhosis. It’s because a person with this health issue might not live until the policy’s expiration date.

Even if he lives for five years, his premiums will still be greater than those of someone who does not have this ailment. Kidney illness is like underwriting guidelines.

It’s vital to understand that an insurer may cancel your funeral insurance policy at any time and for any reason.

Before purchasing a burial insurance policy, you should be aware of all the terms and conditions, as most insurers use them to determine whether to terminate your policy if you pass away during the policy’s term or before its expiration date.

Best Insurance Policy Option If You Have a History Of Cirrhosis Of The Liver

When you apply for burial insurance with cirrhosis, you can see a variety of coverage alternatives.

It’s critical to keep in mind that your decision will be influenced by all of your health conditions. You may have access to a number of coverage options if you have liver cirrhosis.

“Full Protection Immediately” Policy Plan Option:

This is definitely your best option if you have liver cirrhosis and want to purchase burial insurance.

It implies that regardless of your medical situation. At any moment during your life, you will still be able to obtain complete coverage for your funeral expenses.

To compensate, you will typically have to pay a higher premium than someone who does not have a chronic disease or any other pre-existing illnesses.

Most burial insurance providers won’t give you the full death benefit up front. There isn’t any waiting time.

“Graded” Policy Plan Option

If you chose this option, it signifies that even though you had liver cirrhosis and were eligible for burial insurance, you still had some health issues.

Overall, you would receive coverage for the first two years of your policy ownership while paying less than what they would generally charge someone in good health who has never had any pre-existing diseases or chronic illnesses that would have any impact on their applications at all (in terms of premiums).

If you pass away during the first year, this policy will pay at least 30%–40% of your death benefit. We will reimburse you for up to 70-80% of your death benefit if you pass away during the first two years.

“Modified” Policy Plan Option

If you are told you have cirrhosis, you can be eligible for burial insurance. There are some restrictions to be aware of, though.

One of them is that benefits under your insurance won’t start to be paid out until the third year of coverage.

The insurer will not pay anything towards your funeral fees or any other connected expenditures if you pass away within the first two years after acquiring your plan.

Get Declined Altogether

Another possibility is that your medical condition will lead your application to be rejected entirely by your provider.

Before purchasing life insurance with cirrhosis as a pre-existing condition in this situation, it is best to check with multiple carriers so that you can compare rates and discover the best offer on burial insurance for persons with liver disease.

Do I need a medical test to qualify for Burial insurance with cirrhosis and liver disease?

For cirrhosis of the liver insurance, passing a medical exam is not a requirement.

Since liver cirrhosis can be a problem, you could be required to provide some basic health information when applying for burial insurance.

Blood and urine samples, as well as medical documents, are not required. As a result, it is simple and hassle-free.

The first requirement for receiving insurance company approval is a prescription check.

They’ll make sure you aren’t taking any prescriptions that conflict with your plan; in that case, you’ll have to make an extra payment. The response is frequently instantaneous.

Burial Insurance Underwriting With Cirrhosis And Liver Disease

Cirrhosis of the liver and liver disease are both things that insurance companies will look at when deciding whether or not to give you a policy.

Most of the time, they will ask you questions about your general health to learn more about how you are doing.

Some common questions asked about liver cirrhosis are

Have you been diagnosed with liver disease or conditions such as chronic hepatitis or cirrhosis of the liver in the past?

Are you currently suffering from any other medical condition?

How long have you had your current condition?

Have you been diagnosed with cirrhosis or liver disease in the past two years?

Do you know what caused your condition?

Some companies might not use the word cirrhosis specifically in their health questions.

Instead, they might ask a more generic question such, “Have you ever had a liver disease or condition diagnosed or treated?”

Given that cirrhosis is a condition of the liver, you must respond “yes” if you have it.

Live Disease:

If you have liver disease, you might be able to purchase burial insurance if you have liver cirrhosis.

You can still purchase burial insurance if you have cirrhosis of the liver if you have been diagnosed with primary sclerosing cholangitis (PSC), nonalcoholic steatohepatitis (NASH), or cirrhosis.

Liver Transplant

Most insurers will ask about transplants in their health questionnaire. You will see the question asked this way:

Have you ever undergone a liver transplant?

If you have undergone a liver transplant, you will likely be declined for burial insurance with liver cirrhosis.

Most insurance companies believe that patients who undergo transplants are at much higher risk for complications from their underlying condition than others, so they are less likely to pay out if something happens to them.

Are you a candidate for a liver transplant?

If so, you might need to admit to having Hepatitis C and a serious liver ailment.

Your insurance might provide coverage at ordinary rates if you do not have hepatitis C and your liver disease is not severe enough to call for a transplant.

Some insurance companies won’t provide coverage if you have Hepatitis C and a serious liver ailment.

Others might simply provide minimal protection, not covering any illnesses connected to your liver ailment or Hepatitis C treatment (which means no coverage for any other medical need).

Other insurers might provide complete coverage, but at prices that are higher than average.

Benefits of Burial Insurance

There are many benefits of having burial insurance if you have cirrhosis or liver disease. Some of the most important benefits include:

Peace of mind – Having a plan for final arrangements helps your loved ones avoid the additional stress that comes with making decisions during a difficult time.

Financial security – funeral and burial expenses can be costly, and it’s essential for your loved ones not to have to worry about this expense at a time when they are already grieving.

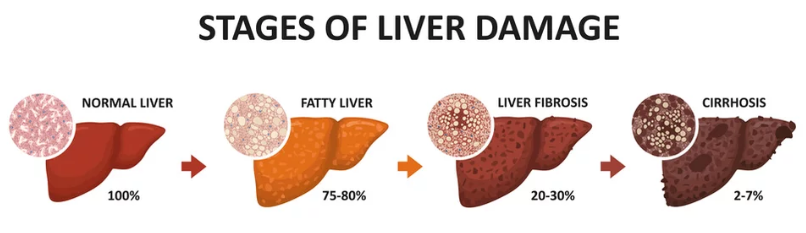

Coverage for all stages of the disease – many burial insurance policies will continue to pay out even if you reach end-stage liver disease, which is why getting coverage as soon as possible is essential.

Avoid debt – If you die before paying off a loan or mortgage, your family will have to pay off the remaining debt. But with a burial insurance policy in place, your family can avoid paying off any loans you may have owed at the time of your death.

How To Find The Best Burial Insurance With Cirrhosis And Liver Disease?

Here’s a list of the qualities to look for in a suitable insurance plan, as well as the company that offers insurance plans for applicants:

The insurance company will accept an applicant with cirrhosis and liver disease without any problems.

The policy has the highest benefit payment that can protect you immediately at a very affordable monthly cost.

One of the significant benefits of using an insurance company over a cash price with a hospital or senior living facility is that you can customize your needs and still have coverage with immediate care.

When considering an insurance agency to provide burial coverage for those with cirrhosis or liver disease, it is essential to find one that possesses the following qualities:

You deserve an insurance agent who is experienced in burial and final expense insurance and passionate about helping you. Not just any insurance company.

The agency must be independent to access multiple insurance companies that could offer the best price.

Agencies only offer the best policies from top-rated insurance companies with a proven track record of paying.

Final Thought

As an independent insurance company, DiabeticInsuranceSolutions.com possesses these characteristics. And even if you have liver disease and cirrhosis, we can still get you these coverage benefits.

People who were having problems getting burial insurance might get it from Diabetic Insurance Solutions. Every person must, in our opinion, have the chance to find serenity in their dying days.

We take great pride in assisting individuals with cirrhosis and liver illness in finding the best burial insurance plans at competitive rates with same-day coverage.

At our insurance company, our knowledgeable Final Expense Insurance Specialists have access to top-rated A+ insurance providers.

These businesses exclusively provide the best insurance coverage together with priceless extra advantages, all without charging extra.

Regardless of their health state, it is our company’s desire to assist customers in obtaining the greatest available burial or final expense insurance coverage. You must provide us with some information!

We want to simplify things for you. We’ll give cheap solutions that meet your needs using this advice.

It might be challenging to plan for the future, but one thing you can do to make things easier on your loved ones is to purchase a burial insurance policy.

With burial insurance, you can reserve funds to pay for funeral expenses without worrying about your family.

To get a price and locate a cost-effective coverage that suits your needs, submit an online application today.